Financial Services

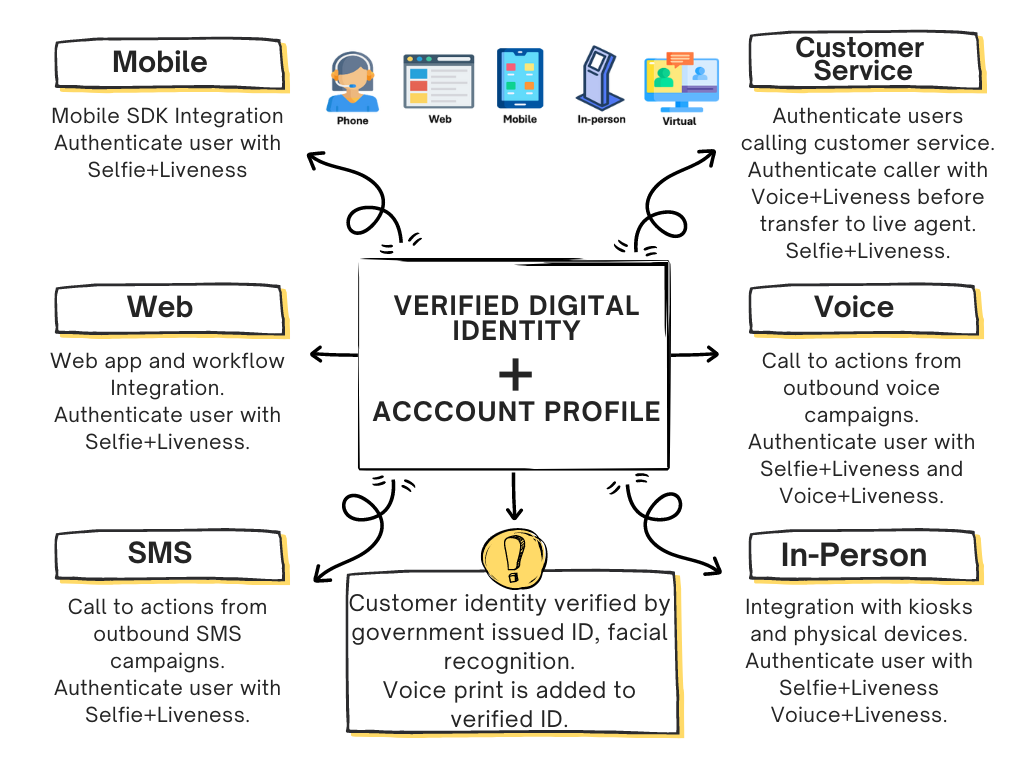

In a digital-first financial ecosystem, protecting customer accounts requires more than passwords and static checks. VerifiNow enables banks, credit unions, fintechs, and other financial institutions to verify and authenticate users seamlessly—across web, mobile, and voice—while preventing account takeover and synthetic identity fraud.

-

Voice Biometrics

-

Facial Recognition

-

Identity Verification

-

eKYC

Trusted Identity. Secured Transactions. Verified Across Every Channel.

eKYC at Account Creation: Verify new customers instantly with document validation, facial biometrics, and liveness detection to ensure compliance with KYC/AML regulations and stop fraud at the front door.

IDV + Facial Biometrics for Transaction Security: Confirm a user’s identity before allowing high-risk actions such as wire transfers, password resets, or contact info changes—reducing the risk of account takeovers (ATO).

Voice Biometrics for Contact Centers: Authenticate customers calling in to customer service using voiceprints and liveness detection, eliminating the need for PINs or security questions while preventing impersonation fraud.

Why VerifiNow?

Omnichannel Authentication: From digital onboarding to contact center interactions, VerifiNow ensures identity is verified at every critical customer touchpoint—without disrupting the experience.

Deepfake and Synthetic ID Protection: Our AI-powered liveness detection thwarts spoofing attempts, deepfake videos, and synthetic identities, delivering real-time confidence that the user is truly present.

Compliance & Confidence: VerifiNow helps financial institutions meet stringent regulatory requirements while delivering seamless, secure service experiences.

Built for Modern Finance

Whether it’s integrating with core banking systems, digital account management platforms, or CCaaS environments like TalkdDesk, Genesys and Twilio, VerifiNow scales with your infrastructure—providing the trust backbone your customers expect.